carried interest tax loophole

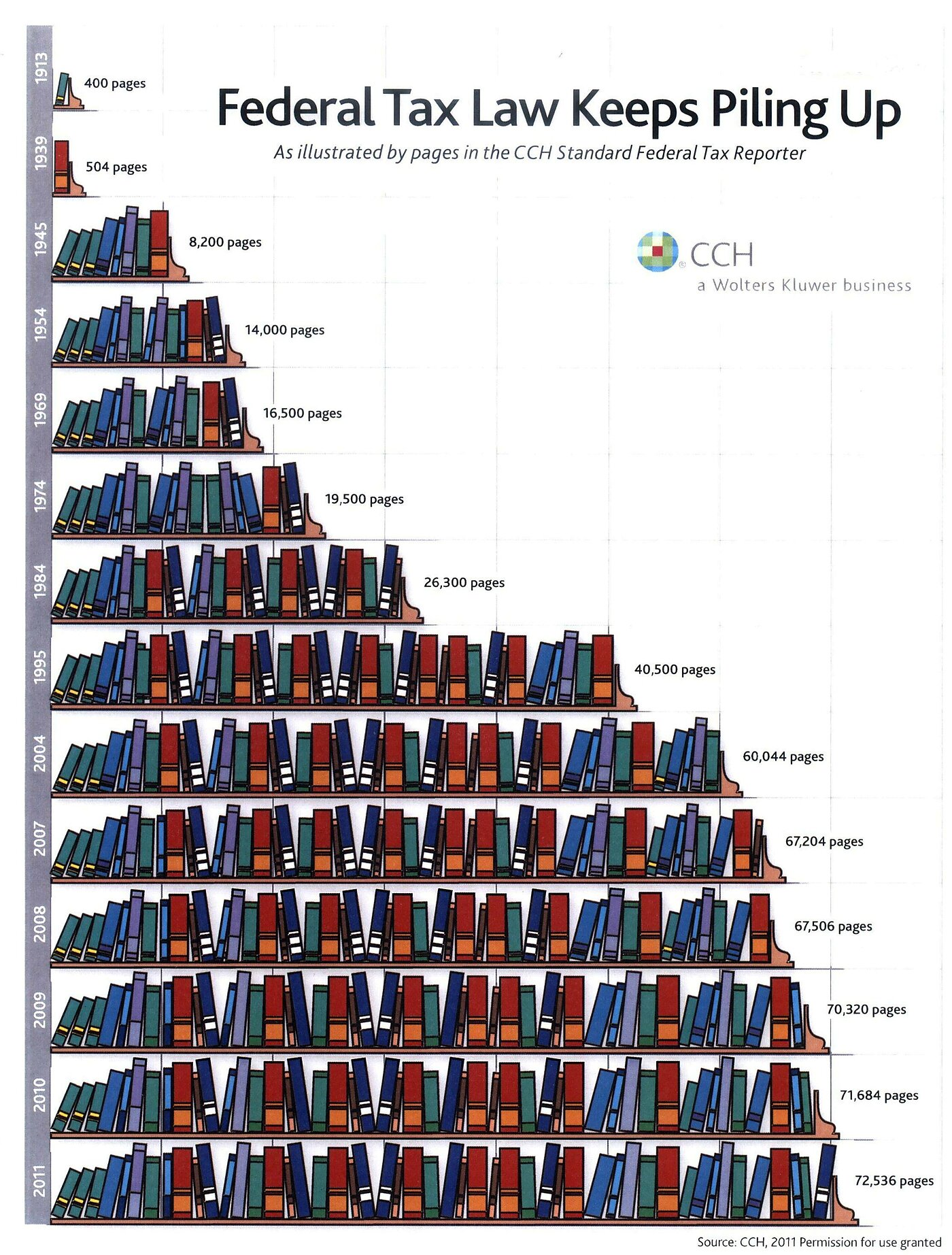

7 hours agoThe carried interest loophole allows hedge fund managers to tax their income at a lower rate than an ordinary salary. Tax code that allows some of the wealthiest people in the country the managers of private-equity.

Bill Ackman Slams Carried Interest Loophole As Democrats Take Aim At Tax Rule

Some view this tax preference as an unfair market-distorting loophole.

. Earlier this week Senators Manchin and Schumer reached an. Obama pledged to do away with it but failed. The loophole exacerbates income and wealth inequality.

The carried interest loophole allows hedge fund managers to tax their income at a lower rate than an ordinary salary. The carried interest loophole has been a target of many presidents. There is actually no such thing as the Carried-Interest Loophole.

Others argue that it is consistent with the tax treatment of other entrepreneurial income. Its so absurd that politicians on both sides of the aisle agree that it should be closed but its been kept open because of the vast sums of money spent to preserve it. Finance Tax.

1 day agoIn Washington the villain is the carried-interest deduction a notorious loophole in the US. The carried interest loophole allows private equity barons to claim large parts of their compensation for services as investment gains. Donald Trump did the same but was.

The carried interest loophole has been a target of many presidents. If it were theyd be taxed at the ordinary income tax rate of up to 37. 8 hours agoTucked inside the sprawling Senate compromise bill for climate change and health care is an effort years in the making to close what Democrats say is a loophole that benefits a handful of the richest Americans.

Inflation Reduction Act of 2022 Aims to Close Carried Interest Loophole. 2 days agoUnder the tax code this isnt considered part of their compensation. The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to substantially lower the amount they pay in taxes.

Carried interest is the percentage of an investments gains that a private equity partner or hedge fund manager takes as compensation. Obama pledged to do away with it but failed. The carried interest tax loophole is the poster child for the corrupting influence of money in politics.

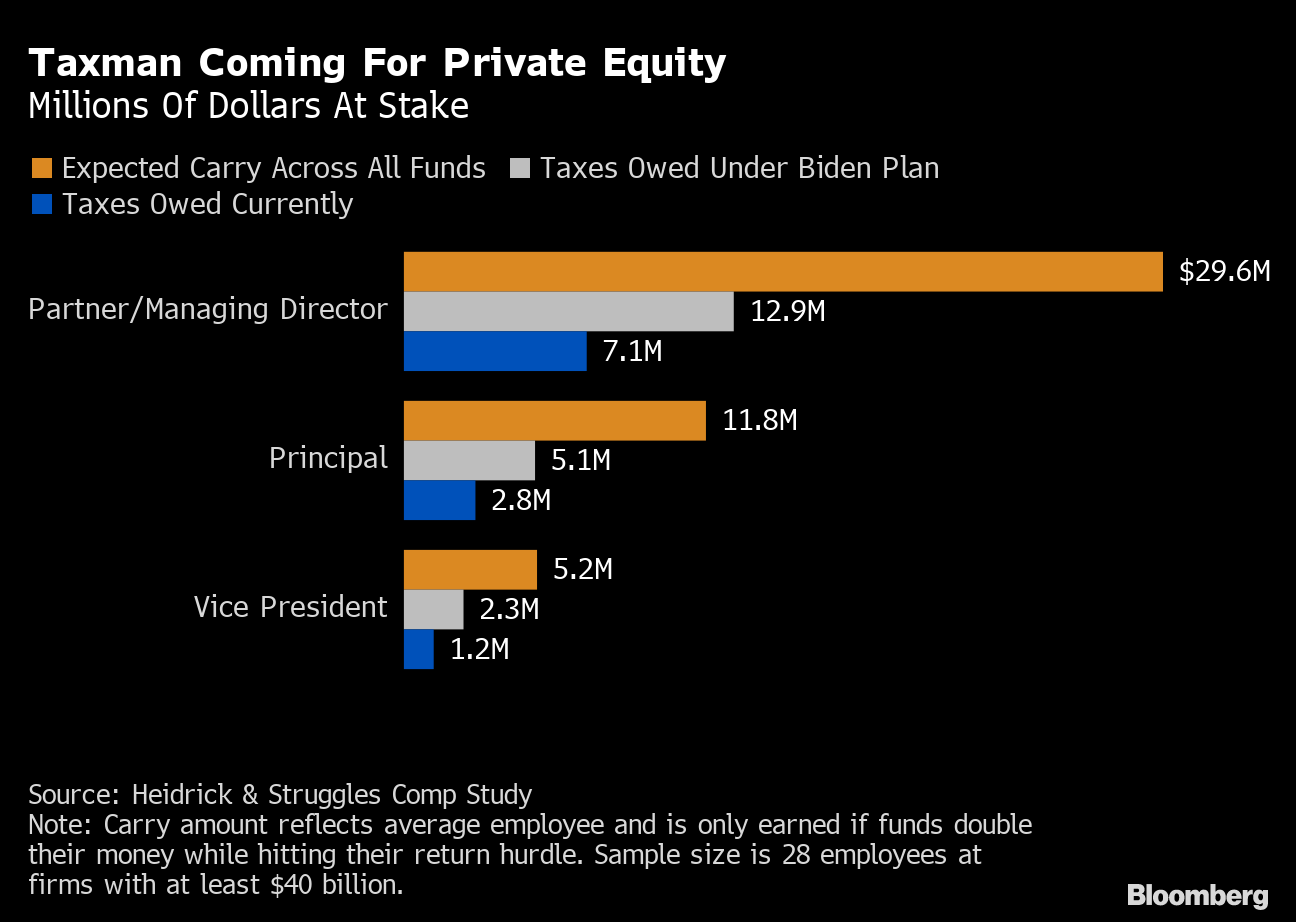

Obama pledged to do away with it but failed. The Wall Street Journal says the 28 top executives of five big private equity firms shared 760 million in carried interest. Try as one might it is impossible to find a special tax rule that allows Hedge Funds and Hedge Fund managers to take advantage of the US tax code in a way that no other investor can.

The lawmakers provided this example. It does not help small businesses pension funds other investors in hedge funds or private equity and everyone in the industry knows it. If the fund manager receives a 20 carried interest in exchange for managing investors capital of 100 million and the prescribed interest rate for the tax.

Thats because when they invest in a company they may receive their cut of. And these folks make a lot of money. The legislative compromise reached last week by Senate Majority Leader Chuck Schumer and West Virginia Democrat Joe.

Obama pledged to do away with it but failed. At most private equity firms and hedge funds the share of. Donald Trump did the same but was.

Thats more than 25 million each. The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to substantially lower the amount they pay in taxes. Carried interest income flowing to the general partner of a private investment fund often is treated as capital gains for the purposes of taxation.

Private equity fumes as Democrats race to tighten tax loophole The paring back of the carried interest loophole could hit the industry at a uniquely challenging time in its history. Carried interest essentially lets investors especially private equity managers pay a lower tax rate on their income. The carried interest loophole is a stain on the tax code.

The carried interest tax.

Senate Reconciliation Bill Would Close Carried Interest Loophole What It Means For Private Equity Barron S

Debunking Fiscal Myths There Is No Loophole For Carried Interest

Zeonzecl On Twitter The Borrowers Things To Come Handouts

Migrant Journal By Offshore Studio Bp O Offshore Studio Journal

How Does Carried Interest Work Napkin Finance

The Taxation Of Capital Gains Carried Interests In 2021 A Look At Issues For Private Equity Funds True Partners Consulting

Turning Losses Into Tax Advantages

Carried Interest Tax Private Equity Billionaires Angry Over Closing Loophole Bloomberg

Turning Losses Into Tax Advantages

Debunking Fiscal Myths There Is No Loophole For Carried Interest Cato At Liberty Blog

Carried Interest In Private Equity Calculations Top Examples Accounting

Carried Interest Calculation Tax Loophole Understanding Pe Vc Youtube